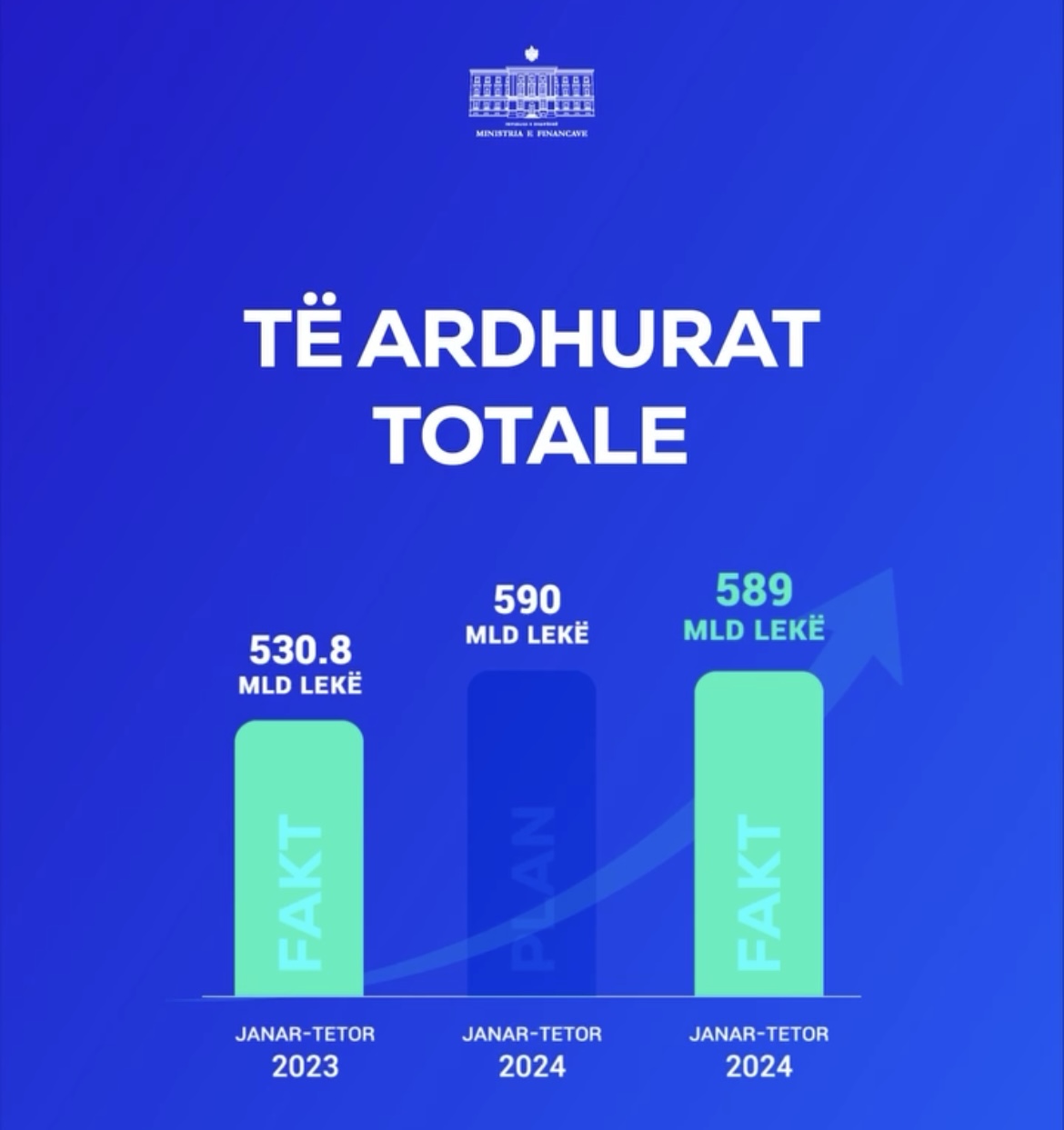

The preliminary performance of consolidated fiscal indicators for January-October 2024 reflects progress in revenue collection and expenditure execution. Total revenues for the first 10 months of 2024 amounted to about 589 billion ALL. Total public expenditure for the first 10 months of 2024 amounted to approximately ALL 517 billion.

Provisional development of revenues and expenditures for the 10 months of 2024:

Total revenue for the 10-month period of 2024 reached approximately 589 billion ALL, achieving 99.8% of the planned target for the period.

Compared to the same period in 2023, 58 billion ALL more was collected, an 11% increase.

Total public expenditures for the 10-month period of 2024 amounted to approximately 517 billion ALL, 91.7% of the planned target for the period and 7.1% higher than the same period in 2023, equivalent to an increase of 33 billion ALL.

Revenue Performance:

- Revenue collected by the General Directorate of Taxation and Customs:

o Total: 513 billion ALL, 99.98% of the 10-month plan, and 46 billion ALL more than the same period in 2023 (10% increase).

- Customs revenues:

o Total: 190.4 billion ALL, 98.3% of the 10-month plan, and 11.4 billion ALL more than in 2023 (6.4% increase).

o VAT on imports: 128 billion ALL, 98% of the plan, and 7.2 billion ALL more than in 2023 (6% increase).

o Excise revenues: 52.5 billion ALL, 99.3% of the plan, and 4.4 billion ALL more than in 2023 (9.3% increase).

o Mining royalties from exports: 2.4 billion ALL, achieving 105% of the plan.

o Customs duties: 7.4 billion ALL, 96.5% of the plan.

- Tax revenues collected by the tax administration:

o Total: 189 billion ALL, 0.9% above the plan and 21 billion ALL more than in 2023 (12.6% increase).

o Net VAT collected: 49 billion ALL, 2.1% above the plan and 8.7 billion ALL more than in 2023 (21.7% increase). VAT refunds totaled 19.6 billion ALL, 0.7% above the plan and 24% higher than in 2023.

o Corporate income tax: 47 billion ALL, 0.4% above the plan.

o Personal income tax: 54.9 billion ALL, 0.8% above the plan and 6.5 billion ALL more than in 2023 (13.5% increase).

o National taxes: 37.8 billion ALL, achieving 99.99% of the plan and 6.7 billion ALL more than in 2023 (21.6% increase).

- Special funds (social and health insurance):

o Total: 133.4 billion ALL, achieving 101% of the plan and 13.4 billion ALL more than in 2023 (11.2% increase).

Expenditure Performance:

- Total public expenditures for the 10-month period of 2024 were approximately 517 billion ALL, achieving:

o 91.7% of the plan for the period.

o 70.1% of the annual plan per the initial budget.

o 67.0% of the annual plan per Normative Act No. 3, dated August 28, 2024.

- Compared to the same period in 2023, expenditures were 7.1% higher or 33 billion ALL more.

- Current expenditures:

o Total: 462.9 billion ALL, 8.1% higher than in 2023 or 34.8 billion ALL more.